Wage calculator wa

CPI Inflation Calculator. TAS Stamp Duty Calculator 2022.

2022 Gross Hourly To Net Take Home Pay Calculator By State

The assumption is the sole provider is working full-time 2080 hours per year.

. The income tax rate ranges from 4 to 109. The Wage Theft Ordinance provides protections against wage theft by requiring payment for all compensation owed for work performed within Seattle city limits requirement payment on a regular pay day and to provide certain written notice to employees about their pay information. The minimum wage for the 2022 calendar year for large and small employers is set forth in the table below.

The National Minimum Wage is the minimum pay per hour almost all workers are entitled to. Industry Productivity Viewer. The WA long service leave calculator can provide an estimate of an employees long service leave entitlement when employment ends as a result of resignation dismissal death or redundancy.

Employment Employment RSE Mean hourly wage Mean annual wage. Injury and Illness Calculator. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The Minimum Wage Ordinance sets the minimum wage for employees working within city limits. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

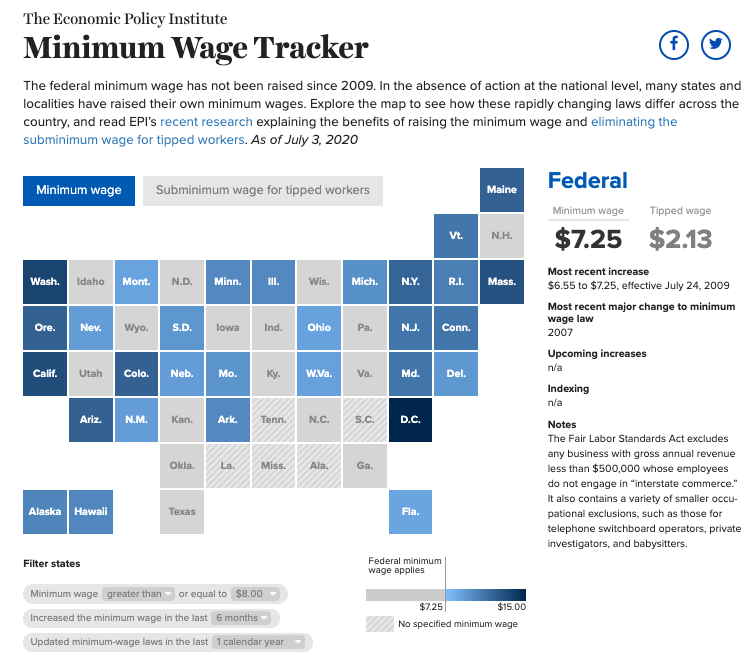

The following list provides information relating to the gross minimum wages before tax social charges of in the European Union member states. The minimum wage a worker should get depends on their age and if theyre an apprentice. The minimum wage increases every year on January 1.

2022 unemployment tax rate calculator xls 2022 unemployment tax rate table pdf 2020 unemployment tax rate FAQ pdf Learn more about how to appeal if you disagree with your unemployment tax rate. In cases where an employee is subject to both the state and federal minimum wage laws the employee is entitled to the higher of the two minimum wages. The majority pay between 56500 to 98000 per year.

Minimum Wage 1369 per hour effective 112021 Labor and Industries - state wage determinations for all counties - use Chrome to view. The tool helps individuals communities and. See below for links to schedules of permanent partial disability PPD down payment amounts and maximum award amounts for specified disabilities.

The minimum wage in the United States of America is set by US. The first federal minimum wage was instituted in the National Industrial Recovery Act of 1933 signed into law by President Franklin D. Washington law requires your employer to provide you with the ability to accrue at least one hour of paid sick leave for every forty hours you work.

Stamp Duty Calculator WA 2022. Being the fourth most populous US state New York state has a population of over 20 million 2021 and is known for its diverse geography melting pot culture and the largest city in America New York CityThe median household income is 64894 2017. OnPay the Washington and Federal.

Minimum Wage 1350 per hour effective 112020. How to File a Complaint with the Wage and Hour Division. How much is stamp duty in WA.

Wagelines new WA long service leave calculator is now available in the long service leave section of the Wageline website. The calculations are based on the assumption of a 40-hour working week and a 52-week year with the exceptions of France 35 hours Belgium 38 hours Ireland 39 hours and Germany 391 hours. Protections for Workers in Construction under the Bipartisan Infrastructure Law.

Injury and Illness Calculator. Seattles Minimum Wage Ordinance went into effect on April 1 2015. Washington Payroll Tax Rates.

Contact the collections unit by emailing esctaxesdwagov for setting up a payment plan. The rates change on 1 April every year. The 2022 average tax rate is 130.

Supplemental to waged PDF 272KB Benefit code key PDF 142KB Past State Prevailing Wages - Published 832020 Effective 922020. Calculate the stamp duty on property purchases in Western Australia WA using our calculator. Living Wage Calculation for Seattle-Tacoma-Bellevue WA.

The WA long service leave calculator is relevant. If your payment plan is approved before. All you need to do is enter wage and W-4 information for each of your go-getting employees and our calculator will take care of the rest.

Employers begin payroll withholding in 2019. These rates are for the National Living Wage for those aged 23 and over and the National Minimum Wage for those of at least school leaving age. You can call us Dr.

Apply to Receptionist Front Desk Agent Construction Laborer and more. Find out what you should earn with a customized salary estimate and negotiate pay with confidence. Paid sick leave is typically full wage replacement where Paid Family and Medical Leave is partial wage replacement use this tool to estimate your pay with Paid Family and Medical Leave.

In 1938 the Fair Labor Standards Act established it at 025 an hour 481 in. Seattles Wage Theft Ordinance went into effect on April 1 2015. 2022 Tax rate calculator.

The average tax rate in recent years has been. Calculate stamp duty for NSW ACT QLD VIC WA SA TAS. WHAT IS THE LIVING WAGE CALCULATOR.

Employment estimate and mean wage estimates for Electricians. An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. Most of EU countries minimum.

Inform your career path by finding your customized salary. Free Washington Payroll Tax Calculator and WA Tax Rates. PPD Award Down Payment Amounts from prior to 1971 to present.

Many states also have minimum wage laws. The federal minimum wage for covered nonexempt employees is 725 per hour. This taxable wage base is 62500.

Has a tax benefit recapture supplemental tax. 267 3139 65290. The average annual Medical LAB Scientist salary as of September 2022 is 76453.

Wage replacement and medical benefits will end after receiving your disability award unless the claim is reopened. Roosevelt but later found to be unconstitutional. Find out if youre eligible for reduced stamp duty.

July 19 2022. Labor law and a range of state and local laws. If you think you may be owed back wages collected by WHD you can search our database of workers for whom we have money waiting to be claimed.

Bureau of Labor Statistics Division of Occupational Employment and Wage Statistics PSB Suite 2135 2 Massachusetts Avenue NE Washington DC 20212-0001 Telephone. Washington workers will have up to 12 weeks of paid family or medical leave starting in 2020.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

3

Paycheck Calculator Washington Wa Hourly Salary

Minimum Wage Tracker Economic Policy Institute

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

1

1

1

What Are Marriage Penalties And Bonuses Tax Policy Center

Seek Pay Calculator Find Out Your Take Home Pay And Taxes Seek

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Medical Examiner Salary In Seattle Wa Comparably

Carpenters

How To Estimate Taxes Estimated Taxes

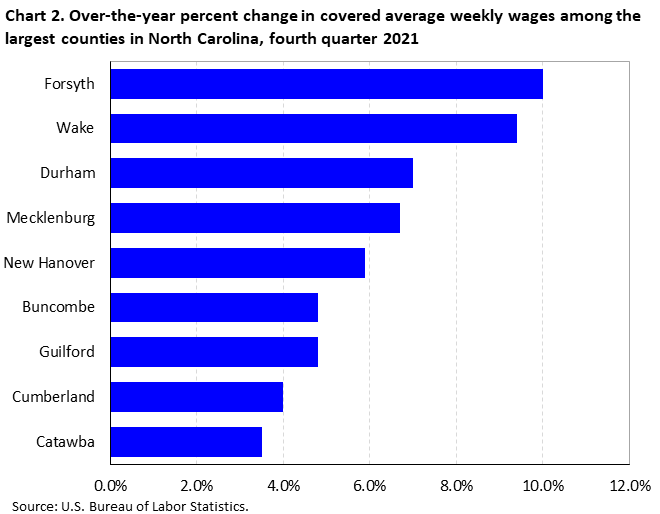

County Employment And Wages In North Carolina Fourth Quarter 2021 Southeast Information Office U S Bureau Of Labor Statistics