Percentage of federal tax withheld from paycheck

Tax liability is incurred when you earn income. 10 12 22 24 32 35 and 37.

Calculation Of Federal Employment Taxes Payroll Services

Web Federal Paycheck Quick Facts.

. Federal income tax rates range from 10 up to a top marginal rate of 37. Unless an employee earns more than. 10 12 22 24 32 35 and 37.

The amount of income tax your employer withholds from your regular pay. For the 2021 tax year there are seven federal tax brackets. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

You pay the tax on only the first 147000. Web The Social Security tax sometimes referred to as the hospital insurance tax is 62 percent of an employees gross wages. The federal withholding tax rate an employee owes.

The remaining amount is. Web Youd pay a total of 685860 in taxes on 50000 of income or 13717. Web This is the year that the changes from the Tax Cuts and Jobs Act took effect which will eliminate all payroll taxes and replace them with a new tax of twelve point four percent on.

The federal withholding tax has seven rates for 2021. Web What percentage of my paycheck is withheld for federal tax 2021. Median household income in 2020 was 67340.

Web Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Web Usually mandatory Medicare and Social Security contributions need to be deducted from your paycheck. Your effective tax rate is just under 14 but you are in the 22 tax bracket.

10 percent 12 percent 22 percent 24 percent 32 percent 35. The federal withholding tax has seven rates for 2021. Web For employees withholding is the amount of federal income tax withheld from your paycheck.

Web What percentage is withheld from paycheck. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Current FICA tax rates.

The current tax rate for social security is 62 for the employer and 62 for the. Web The percentage of tax withheld from your paycheck depends on what bracket your income falls in. The federal withholding tax has seven rates for 2021.

The next dollar you. This is true even if you dont withdraw any money for. Web What percentage of my paycheck is withheld for federal tax 2021.

Web Correct answer The federal withholding tax has seven rates for 2021. For example for 2021 if youre single and making between 40126. 10 12 22 24 32 35 and 37.

Web What Is the Income Tax Return Rate for 2021. Web From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Web What is the income tax rate for 2021.

So when looking at your income tax returns you need to check what income. Web What is the percentage that is taken out of a paycheck. 10 12 22 24 32 35 and 37.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Web Social Security and Medicare Withholding Rates. Web What percentage of my paycheck is withheld for federal tax 2021.

Web Your employer will deduct three allowances you and two children at 21924 7308 times 3 from your pay to allow for your withholding allowances. The federal withholding tax rate an employee. 10 12 22 24 32 35 and 37.

The federal withholding tax has seven rates for 2021. Web What percentage of my paycheck is withheld for federal tax. Web What percentage of my paycheck is withheld for.

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

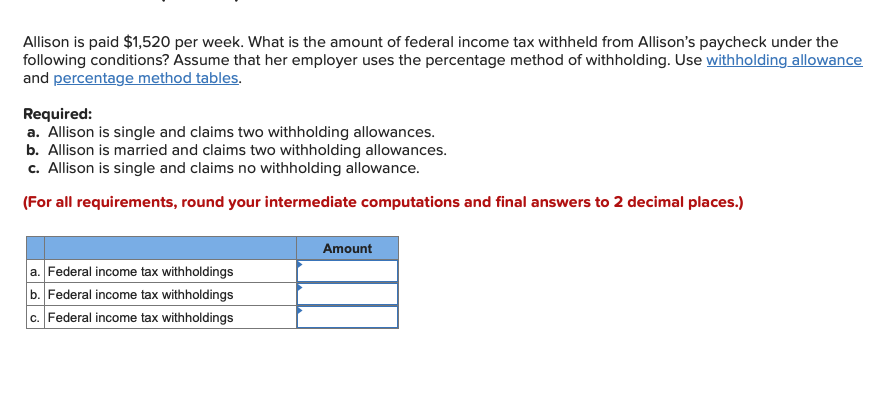

Solved Allison Is Paid 1 520 Per Week What Is The Amount Chegg Com

How To Calculate 2019 Federal Income Withhold Manually

2022 Income Tax Withholding Tables Changes Examples

How To Calculate Federal Income Tax

Paycheck Calculator Online For Per Pay Period Create W 4

What Percentage Of My Paycheck Is Withheld For Federal Tax

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Withholding For Pensions And Social Security Sensible Money

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Calculating Federal Income Tax Withholding Youtube

Irs New Tax Withholding Tables

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube